Below is a detailed analysis post based on “The Humanoid 100: Mapping the Humanoid Robot Value Chain” report. This post provides an overview of a complete list of approximately 100 companies, a breakdown by key segments (Brain, Body, and Integrators) with regional and country distributions, and in-depth analysis of the technological and market roles of major companies within each segment along with investment insights.

Global Humanoid Robot Ecosystem – In-Depth Analysis Based on the “Humanoid 100” Report

Morgan Stanley recently released “The Humanoid 100: Mapping the Humanoid Robot Value Chain” report, in which approximately 100 publicly listed companies that are closely related to the humanoid robot ecosystem are selected and systematically classified into three core segments: Brain, Body, and Integrators. This report demonstrates how AI is expanding from the digital realm into the physical world (robots) and suggests that the total addressable market (TAM) for humanoid robots could reach up to $60 trillion. In the sections that follow, we delve into the detailed composition of each segment, the country and regional distribution of these companies, and provide an in-depth analysis of the key technological and market roles, as well as investment insights for each segment.

1. Report Overview and Classification Framework

1.1 Purpose of the Report

• Objective:

To provide investors with a clear picture of the “humanoid robot” investment theme by presenting a “full list” of key publicly listed companies in the industry.

• Outlook:

The report forecasts that, along with the physical realization of robots impacting global GDP and labor markets, humanoid robots will emerge as a major technology investment theme within the next decade.

1.2 The Three Core Segments

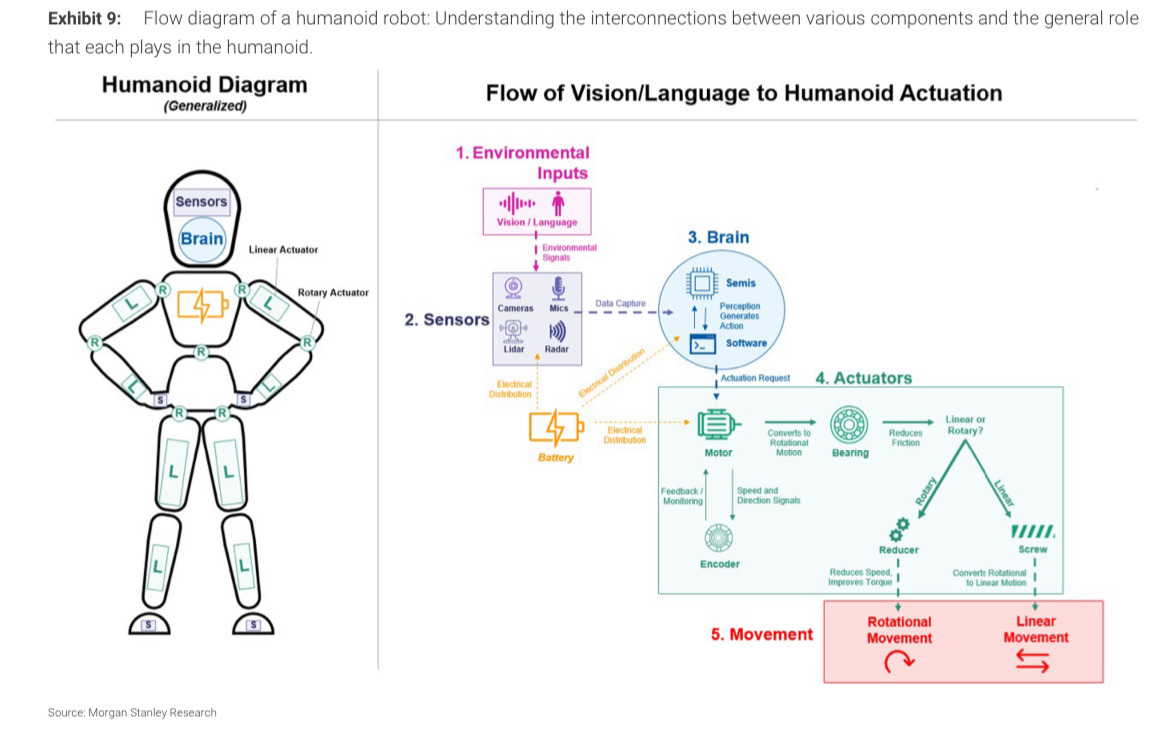

Morgan Stanley has classified the roughly 100 companies into the following three segments:

• Brain (22 companies):

• Role: Responsible for the “brain” of robots, including artificial intelligence, software, simulation, and digital twin technologies that support autonomy, learning, reasoning, and environmental perception.

• Representative Companies: NVIDIA, Alphabet, Microsoft, Meta, Baidu, Arm, Synopsys, etc.

• Body (64 companies):

• Role: Provides the physical components of robots such as sensors, actuators, motors, gear reducers, and batteries necessary for movement, manipulation, sensing, and energy supply.

• Representative Companies: CATL, LG Energy Solution, Samsung SDI, Harmonic Drive Systems, Hiwin, Hota, LeaderDrive, NSK, Analog Devices, Robosense, etc.

• Integrators (22 companies):

• Role: Develop complete humanoid robots or provide integrated solutions, including design, prototype development, and commercialization.

• Representative Companies: Tesla, Hyundai (including the Boston Dynamics family), Toyota, BYD, XPeng, Apple, Xiaomi, Alibaba, Amazon, Naver, Tencent, ABB, Midea, UBTech, Rainbow Robotics, etc.

In total, 22 + 64 + 22 ≈ 108 companies have been selected (adjusted to around 100 in the report), reflecting the diversity and complexity of the current humanoid robot industry.

2. Country and Regional Distribution

According to the report, the distribution of publicly listed companies participating in the humanoid robot ecosystem is as follows:

• Asia:

• About 73% of the participating companies are based in Asia, with more than 56% of these located in China and Taiwan.

• Particularly in the Body segment, Chinese companies hold more than 63% of the global parts supply chain share due to cost competitiveness, government support, and mature manufacturing infrastructure.

• United States and Canada:

• This region mainly includes global big tech companies in the Brain segment (such as Alphabet, Microsoft, NVIDIA) and some Integrator companies.

• Europe and Other APAC Regions:

• European and other Asian countries are responsible for niche segments such as precision sensors and gear reducers, with certain EMEA companies showing competitiveness in specific areas.

3. Detailed Analysis by Segment

3.1 Brain – The “Brain” of Robots: AI, Software, and Semiconductor/Software Solutions

Key Roles:

• Develops foundational generative AI models, simulation technologies, and digital twin capabilities to enhance robot autonomy and learning.

• Supports robots’ reasoning and decision-making processes through advanced semiconductor and software solutions.

Notable Companies and Their Characteristics:

• NVIDIA (NVDA):

• Provides robotics simulation and autonomy technologies through initiatives like Project Gr00t.

• Plays a critical role in powering robot brains with high computational capabilities and an extensive AI chip ecosystem.

• Alphabet (GOOGL) & Microsoft (MSFT):

• Leverage platforms like Google DeepMind and Azure Cloud to support robotic learning, simulation, and data analysis.

• Are leaders in developing AI software and models.

• Meta (META):

• Enhances robot control capabilities by developing proprietary AI models and simulation tools.

• Baidu:

• Complements robotics research in China with dedicated research groups and partnerships focused on visual recognition chips.

• Arm, Synopsys, Cadence:

• Develop customized semiconductor design and chip optimization solutions specifically for humanoid robots.

3.2 Body – The Hardware Components for Robots

Key Roles:

• Supplies components critical for robots’ movement, sensing, and energy management.

• Ensures robot performance and durability through high-precision sensors, actuators, batteries, motors, and gear reducers.

Key Components and Associated Companies:

• Batteries and Power:

• CATL, LG Energy Solution, Samsung SDI:

Supply high-energy-density and stable battery cells, leveraging technology similar to that used in electric vehicles.

• Actuators and Mechanical Components:

• Harmonic Drive Systems, Hiwin, Hota, LeaderDrive, NSK:

Enable complex robotic movements, exemplified by systems like Tesla Optimus Gen2, which utilizes 28 actuators to achieve 50 degrees of freedom.

• Sensors and Vision Systems:

• Analog Devices, Intel, Keyence, Robosense, Sony Group:

Provide high-resolution cameras, LiDAR, and force/torque sensors to support environmental perception.

• Structural and Connectivity Components:

• Amphenol, TE Connectivity:

Offer cabling and connector solutions essential for power and data transmission.

Market and Technical Insights:

The Body segment is predominantly led by Chinese and Taiwanese companies, leveraging low-cost production, strong governmental support, and mature supply chains to drive the global hardware market for humanoid robots.

3.3 Integrators – Developing Complete Humanoid Robots

Key Roles:

• Integrates all robotic components to develop and commercialize fully functional humanoid robots.

• Includes companies from various sectors, such as automotive, consumer electronics, internet services, and traditional robotics manufacturers.

Notable Companies and Their Characteristics:

• Automotive/Mobility:

• Tesla:

Develops the Optimus robot, aiming to integrate autonomous driving and robotics, with CEO Elon Musk predicting that robots will become a core revenue driver in the future.

• Hyundai (including Boston Dynamics affiliates):

Combines automotive manufacturing expertise with robotics to develop industrial and service robots.

• Toyota:

Focuses on humanoid research through projects like the T-HR3, emphasizing human-like motion.

• Consumer Electronics:

• Apple, Xiaomi, Sony:

Expand into humanoid applications beyond traditional consumer devices, exploring smart home and personal robotics.

• Internet and E-Commerce:

• Alibaba, Amazon, Tencent, Naver:

Develop AI-based robotic solutions aimed at automating logistics, enhancing service operations, and increasing efficiency.

• Traditional Robotics Manufacturers:

• ABB, Midea (KUKA), Teradyne:

Leverage decades of experience in industrial robotics to lead the market in collaborative and service robots.

• Dedicated Humanoid Players:

• UBTech, Rainbow Robotics:

Focus solely on humanoid robot development, representing pure-play innovators in the field.

Market Insight:

Integrator companies are transitioning from development to commercialization, and entities like Tesla are expected to make robots a significant part of their overall business.

4. Country and Regional Breakdown

According to the Morgan Stanley report, among the approximately 100 companies selected:

• Brain Segment: 22 companies

– Primarily includes major US and Canadian big tech companies (Alphabet, Microsoft, NVIDIA, Meta) along with some European and Taiwanese semiconductor design firms.

• Body Segment: 64 companies

– Dominated by Chinese and Taiwanese companies, which account for over 63% of the global supply chain for components.

• Integrators Segment: 22 companies

– Consists of global giants from the US, China, and Japan, with strong representation in automotive and consumer electronics.

• Regional Distribution:

Approximately 73% of the companies are based in Asia (especially China and Taiwan), around 17% in the US and Canada, with the remaining companies spread across Europe and other regions.

5. Investment Insights and Future Outlook

5.1 Trends in Technology and Market Dynamics

• Ecosystem Expansion:

The convergence of AI and physical robotics is creating new market opportunities in “embodied AI,” poised to revolutionize various industries within the next decade.

• Cost Reduction and Supply Chain Maturity:

Particularly in the Body segment, Chinese companies leverage cost competitiveness and robust government support, which is expected to continuously lower the average selling price (ASP) and the bill of materials (BOM).

• Global Competitive Landscape:

US and European big tech firms lead the Brain segment with strong technological and data ecosystems, while companies such as Tesla, Hyundai, and Toyota drive the commercialization and mass production of humanoid robots in the Integrators segment.

5.2 Key Investment Points

• Early Mover Advantage:

Although the humanoid robot market is still in its early stages, Morgan Stanley forecasts a total addressable market (TAM) of up to $60 trillion, presenting enormous growth potential.

• Core Competencies by Company:

– NVIDIA, Alphabet, and Microsoft deliver robust AI and computing power.

– CATL, LG Energy, and Samsung SDI provide critical battery and energy management technologies for sustaining robots.

– Tesla, Hyundai, and Apple are leading the way in integrating and commercializing complete humanoid robots.

• Regional Strategies:

The complementary strengths of China’s manufacturing and supply chain capabilities and the software and AI prowess of the US and Europe suggest that a diversified investment strategy may be promising.

6. Conclusion

Morgan Stanley’s “Humanoid 100” report illustrates that the humanoid robot industry is not merely a futuristic technology—it is already a core theme influencing global investment, GDP, and labor markets.

• Brain Segment:

AI and semiconductor technologies are forming the “brain” of robots, predominantly led by US big tech companies.

• Body Segment:

Chinese and Taiwanese companies dominate the hardware aspect, supplying high-precision components and leveraging mature manufacturing capabilities.

• Integrators Segment:

Global companies like Tesla, Hyundai, and Apple are actively pushing for the commercialization of fully functional humanoid robots, which will be a key determinant in shaping future market dynamics.

The growing adoption and technological advancements in humanoid robots will have far-reaching effects on labor markets, manufacturing, consumer services, and other sectors, thereby creating new investment opportunities. Investors are encouraged to closely analyze the technological capabilities and market positions of key companies in each segment to identify those with high future growth potential.

This analysis is based on the core content and overall data from Morgan Stanley’s “Humanoid 100” report, offering a comprehensive overview of the roles and technological features of major companies across different segments. For more detailed figures and the latest information, please refer to the original Morgan Stanley report and conduct further financial and market trend analysis before making investment decisions.

I hope this detailed English version provides a comprehensive understanding of the “Humanoid 100” report, the distribution of companies by segment and region, and the investment insights for the future of the humanoid robot industry.

'IT & Tech 정보' 카테고리의 다른 글

| Huawei – Pioneering Innovation and Shaping the Future at MWC2025 (0) | 2025.02.17 |

|---|---|

| 스크린 홀딩스(다이닛폰 스크린) 개요 주요 제품 주가 현황 전망 (0) | 2025.02.17 |

| Global Smartphone Market Share in 2024 – by Manufacturer and Nationality (0) | 2025.02.17 |

| MWC2025 Special: Oppo & Vivo – Pioneers Shaping the Future of Mobile Technology (0) | 2025.02.17 |

| Xiaomi – Innovación, Estrategia Global y el Futuro en MWC2025 (0) | 2025.02.17 |