Swiss franc banknotes, a currency increasingly favored by investors seeking stability. The Swiss franc’s reputation as a “safe haven” asset has grown amid global economic uncertainties.

Swiss Franc Deposits Double Among Rich Investors

Amid concerns that holding wealth in Korean won could be precarious (“한국 돈만 갖고 있으면 위태위태”), many of Korea’s affluent investors are reallocating funds into Swiss franc assets. Recent data from major Korean banks shows that Swiss franc-denominated deposits have surged by about 129% in just six months, roughly doubling from the end of 2024 to June 2025. This reflects a broader trend of high-net-worth individuals seeking refuge in the Swiss franc – a currency widely regarded as one of the world’s premier safe-haven currencies, alongside the US dollar and Japanese yen . In the words of one 60-year-old Korean business owner with hundreds of billions of won in assets, “Having only Korean money feels risky. The Swiss franc’s stability gives me psychological comfort,” indicating the strong trust these investors place in the franc’s steady value.

Switzerland’s Rock-Solid Economic Foundations

Why the Swiss franc? The answer lies in Switzerland’s exceptional economic fundamentals and fiscal prudence. Despite a population of only about 9 million (and a land area half the size of Korea), Switzerland punches far above its weight in financial stability. Key factors underpinning the Swiss franc’s strength include:

• Consistent Trade Surpluses: Switzerland runs one of the highest current account surpluses relative to GDP in the world. Its export-oriented economy, powered by high-value goods like pharmaceuticals, precision machinery, luxury watches and chocolates, has kept the current account in surplus (averaging >4% of GDP since the 1980s) . In fact, over half of Swiss exports are advanced “high-tech” products – more than double the share in the US – which allows Switzerland to earn robust export income. These earnings are often reinvested abroad; consequently Switzerland now boasts a net international investment surplus exceeding 100% of its GDP, buffering it against external shocks . Such a strong external balance sheet is the opposite of deficit economies and underpins long-term confidence in the currency.

• Fiscal Discipline by Law: Switzerland is renowned for fiscal conservatism. The government historically runs balanced budgets or surpluses, and it even has a “debt brake” constitutional rule (enacted in 2003) that prevents the federal budget from going into deficit . In practice, this rule requires that spending not exceed revenue over the economic cycle, effectively curbing excessive debt accumulation. This kind of legally mandated prudence means the Swiss franc isn’t at risk of debasement from runaway government spending. Tellingly, Swiss voters themselves strongly favor fiscal responsibility – in a 2016 referendum, 76.9% of voters rejected a proposal for a guaranteed basic income for all adults (about CHF 2,500 per month) because of concerns about the cost and its impact on national competitiveness . Even a seemingly attractive “free money” policy was turned down by the public, underscoring how highly Swiss society values financial stability and sound public finances.

• Political Stability and Neutrality: Switzerland’s longstanding political neutrality and stable governance contribute to its safe-haven status . The country has avoided entanglement in major conflicts and maintains a predictable, investor-friendly environment. This stability reduces risk for those holding Swiss francs, as there is little fear of sudden political or economic upheaval.

• Competitive, High-Quality Exports: Switzerland defies the usual assumption that a strong currency hampers exports. Its companies compete on quality rather than price. Indeed, Swiss exports are near historic highs as a share of GDP (about 75%) and even as a share of global exports (around 2%)  – remarkable for a small economy. Global customers are willing to pay a premium for the “Made in Switzerland” label, reflecting extraordinary quality and innovation . This means Swiss firms can thrive even with an expensive currency, sustaining the economic strength behind the franc. As one analysis noted, Switzerland has quietly built an “all-weather economy”: the franc has continued to appreciate steadily over decades, regardless of whether the U.S. dollar was up or down, or whether the global economy was in recession or growth – a testament to Swiss competitiveness and resilience .

The combination of these factors – trade surpluses, a strong industrial base, prudent budgets, and political stability – has earned the Swiss franc a reputation as one of the world’s safest assets. Investors know that holding wealth in francs means tying one’s fortunes to a nation with low inflation, high productivity, and a conservative financial ethos. When markets turn turbulent, this foundation becomes a sanctuary.

A Track Record of Strength and Safety

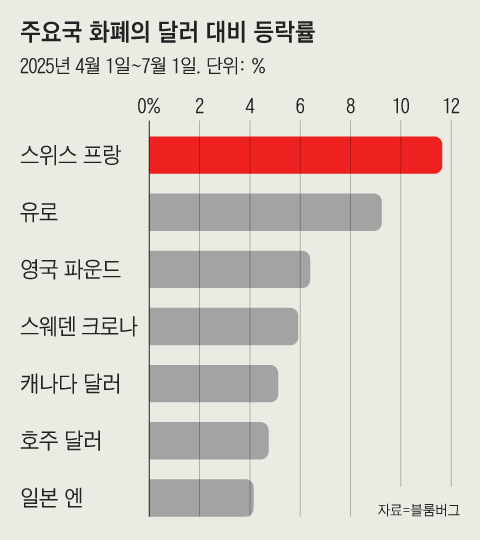

It’s not just theory – the Swiss franc’s performance over time backs up its safe-haven status. By multiple measures, the franc has been the strongest major currency in the world over the long run. According to an analysis in the Financial Times, the Swiss franc was the top-performing currency over the past 50 years, 25 years, 10 years, and 5 years – effectively any long-term horizon . Few currencies can rival this durable strength. Even in more recent periods, the franc consistently holds its value or gains when others falter. For instance, by mid-2025 the Swiss franc’s real effective exchange rate (which adjusts for inflation and trade with partner countries) had climbed near its highest levels of the past year, meaning the franc’s purchasing power remains very strong against a basket of currencies. In other words, it’s not just gaining nominally against the dollar or euro; it’s also gaining in real terms, underscoring that Swiss inflation is even lower than elsewhere.

Global investors clearly recognize this strength. Whenever geopolitical or economic anxieties spike, demand for Swiss francs surges. A recent example occurred in June 2025: after a sudden outbreak of military conflict in the Middle East (Israel’s strikes on Iran), investors flocked to traditional safe havens. The Swiss franc sharply appreciated to record highs against the U.S. dollar in the immediate aftermath  . In fact, it briefly touched CHF 0.808 per USD – the franc’s strongest level in decades – before settling around CHF 0.81 per USD . This leap reflected a flight-to-safety in real time. (Gold prices also spiked and stock markets tumbled during the same episode, painting a classic “risk-off” picture.) Currency analysts noted that such geopolitical tensions “naturally favour safe havens,” with the franc among the prime beneficiaries . The Japanese yen – another safe haven – also saw inflows, though interestingly the yen has not kept pace with the franc’s strength in recent years.

Notably, the Swiss franc has shown an ability to hold its value through many crises: from the global financial crisis of 2008, the eurozone debt crisis, the pandemic shock, and various geopolitical flare-ups, the franc typically appreciates or at least remains stable when risk assets decline. This resilience is exactly what wealthy investors are seeking when they talk about an asset that makes them feel “secure.” It acts as a form of insurance for their portfolio.

Global Wealthy Eye the Swiss Franc

The shift into Swiss francs isn’t confined to Korean investors. Wealthy individuals across other countries, including Japan, are also gravitating toward the Swiss franc as a hedge against geopolitical risks like wars and trade conflicts. In Japan, private banking advisers have reported increased interest in Swiss franc accounts among high-net-worth clients, paralleling the Korean trend. The motivations are the same: fears of local currency depreciation, and a desire to shelter wealth in an internationally recognized safe asset. With global uncertainty elevated – be it due to ongoing trade disputes, regional security threats, or volatile equity markets – the appeal of the franc has broadened. As one senior analyst, Juntaro Morimoto of Sony Financial Group, observed, Switzerland’s major export industries (pharmaceuticals, chemicals, precision instruments, luxury goods) have such global competitiveness that their earnings aren’t very sensitive to exchange rate swings. This means Switzerland’s trade remains robust even when the franc is strong, enabling continuous trade surpluses that naturally push the currency upward over time. In short, Switzerland’s economic structure itself fosters a strong currency, and international investors are well aware of this dynamic.

Another aspect drawing investors is Switzerland’s commitment to long-term stability over short-term gain. An illustrative anecdote is how Swiss citizens value stability: in the 2016 basic income referendum mentioned earlier, an overwhelming majority voted against a policy that could have undermined fiscal discipline . This kind of cultural ethos – prudence, caution, and forward-thinking – reassures foreign investors that Switzerland won’t erode the value of its currency with populist spending. In contrast, many other countries periodically flirt with expansive fiscal or monetary policies that weaken their currencies. The Swiss franc, by virtue of Switzerland’s system, provides a measure of insulation from such policy-driven volatility.

A “Risk Hedge” Asset, Not a High-Yield Play

It’s important to note that the Swiss franc is not held for high returns in the form of interest or rapid speculative gains – it’s held as a risk hedge. Swiss franc investments prioritize capital preservation over yield, which suits the needs of the ultra-wealthy during turbulent times. In fact, holding Swiss cash or deposits yields minimal income. The Swiss National Bank (SNB) has one of the lowest policy interest rates in the world – as of June 2025, the SNB even cut its rate down to 0%  (after having been at a mere 0.5% prior), returning to an effective zero or negative real rate environment. By comparison, other central banks (like the US Federal Reserve or Bank of Korea) have much higher rates, so parking money in francs actually forgoes interest income. Moreover, the Swiss franc market is relatively less liquid than major currencies like the dollar or euro, and buying/selling CHF can incur higher exchange fees or wider bid-ask spreads, especially in places like Korea. These factors make the franc ill-suited for quick trading profits or “carry trade” strategies.

Yet, despite near-zero yield, demand for the franc persists because its value stability is the primary goal. For wealthy investors, avoiding large losses is far more important than earning high interest. By diversifying into Swiss francs, they gain a form of insurance that when other assets (stocks, real estate, or even the local currency) are swinging wildly or losing value, the Swiss franc portion of their portfolio is likely to hold steady or appreciate. This cushions the overall portfolio. Financial advisors often emphasize that in a proper asset allocation, some portion should be in safe-haven currencies precisely to lower volatility and preserve capital during crises. As a CME Group analysis noted, holding safe-haven currencies can diversify holdings and reduce overall portfolio volatility, and many investors use them to “hedge against potential losses” in riskier assets . The primary goal in such times is capital preservation, and safe havens provide a “shelter” for wealth  – the Swiss franc fits this role perfectly.

In this sense, the Swiss franc serves as a “psychological safety net” for its holders. Knowing that a chunk of one’s wealth is in a currency extremely resistant to inflation and turmoil can grant peace of mind. It’s the classic strategy of “not putting all your eggs in one basket,” extended to currencies. For Korea’s rich, who may already have significant exposure to domestic assets (won, local stocks, real estate), adding Swiss francs is a way to balance out that exposure with something that tends to zig when the others zag.

Conclusion: The Ultimate Safe-Haven Currency

The recent rush of Korea’s big investors into Swiss francs underlines a broader investment truth: when uncertainty rises, wealth seeks safety. The Swiss franc, underpinned by Switzerland’s prudent economic management and strong external fundamentals, has proven itself as a premier safe-haven asset over decades . It may not generate high yield, but it offers something arguably more valuable – reliability and protection against loss. As other assets waver with market winds, the Swiss franc stands as a bulwark of stability. This is why those who have the most to lose (the ultra-wealthy) are increasingly entrusting a portion of their fortunes to the humble Swiss franc. In the pursuit of “잃지 않는 투자,” or investing not to lose, the Swiss franc has become a star performer, living up to its reputation as “안전자산의 끝판왕,” or the ultimate safe-haven asset.

Sources: Recent financial analysis and news reports have been used to support this overview, including data on Swiss franc performance and expert commentary on its safe-haven role    . The Swiss National Bank’s public statements confirm its ultra-low interest rate policy , and historical examples like Switzerland’s 2016 basic income referendum highlight the country’s fiscal ethos . These factors collectively explain why the Swiss franc is attracting significant interest from risk-conscious investors today.

'get rich' 카테고리의 다른 글

| 2025년 7월: 스테이블코인 법제화 수혜 유망 알트코인 총정리 (0) | 2025.07.25 |

|---|---|

| 유망 코인 목록 및 요약 (0) | 2025.07.19 |

| 미국 최초의 가상자산 법률 및 401(k) 대체투자 개방 – FAQ (0) | 2025.07.19 |

| 국내 주요 보험사 분석: 생명보험사 vs 손해보험사 (0) | 2025.07.19 |

| 보험사별 보험상품 비교: 최적의 선택을 위한 가이드 (0) | 2025.07.19 |