South Korea’s economy in 2026 faces a challenging environment marked by a persistently weak currency, lingering inflationary pressures, and an uncertain global trade backdrop. A recent survey of 25 Korean economic experts indicates that the won-dollar exchange rate will likely remain in the high 1,400s on average next year, higher than this year’s level . Despite these headwinds, a majority of experts anticipate modest GDP growth of around 1.8% or above – aided by expansionary fiscal policy and a rebound in exports – but only if key risks such as semiconductor demand hold steady . Inflation, however, is expected to slightly exceed the central bank’s 2% target, given the currency weakness and other cost pressures . Navigating these dynamics will require careful balancing of policy to sustain recovery without exacerbating financial vulnerabilities.

Won Expected to Stay Weak in 2026

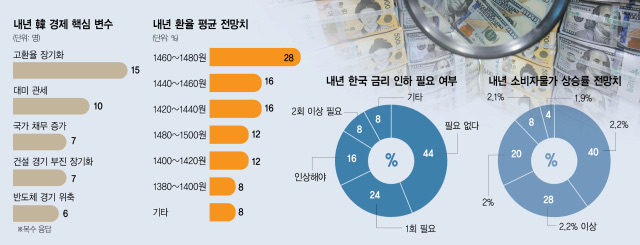

Currency experts foresee the Korean won remaining weak against the U.S. dollar in 2026, continuing the trend of 2025. About 60% of surveyed economists predict the average USD/KRW exchange rate will range between ₩1,440 and ₩1,500 next year . Notably, the largest subgroup (28% of respondents) expects an average around ₩1,460–₩1,480  – implying roughly ₩1,470 per dollar as a common forecast. Such levels would represent a further depreciation of the won compared to 2025’s average (~₩1,421), which was already the weakest since the 1997–98 Asian Financial Crisis (surpassing the 1998 average of ₩1,394) . In other words, the high exchange rate has become a “new normal”, and 2026 will test how well Korea’s economy can adapt to a won in the mid-₩1,400s  .

Several factors underpin this persistent weakness of the won. Korea’s interest rates have been on a downward path in 2024–2025, while U.S. rates remained high, narrowing the rate differential and putting pressure on the won. In late 2025, the Bank of Korea (BOK) signaled an end to its rate-cut cycle, largely because a “tumbling won” reduced the scope for further easing . BOK Governor Rhee Chang-yong warned that the weak won could stoke import-price inflation, saying “as the won stayed weak… it could work to increase prices” . Additionally, capital flow trends have weighed on the currency – for example, heavy buying of U.S. stocks by Korean investors and pension funds in Q4 2025 pushed the won nearly 4% lower in that quarter (making it Asia’s second-worst performing currency after the yen) . These conditions suggest the won’s downward pressure may persist into 2026 unless global financial conditions change markedly.

Figure: Survey results from Korean experts on the 2026 outlook. Left – Key risk factors cited for 2026 (number of expert responses); Center – Expected average won–dollar exchange rate range in 2026 (in KRW per USD, with percentage of experts forecasting each range); Bottom-Left – Expert views on whether BOK should cut interest rates further next year; Bottom-Right – Expected 2026 consumer inflation rate (CPI) ranges. High exchange rates (weak won) were the most cited risk (15 responses), and a plurality forecasts the won averaging around ₩1,470 per USD. Most experts do not see a need for further rate cuts (44% said no cut needed), and 76% expect inflation to exceed 2.1%  .

Key Risks: High Exchange Rate, Trade Tensions, and Debt

The won’s sustained weakness isn’t just a forecast – experts overwhelmingly see it as the top risk for the Korean economy in 2026. In the survey, 15 out of 25 respondents (60%) identified a prolonged high exchange rate as the biggest risk factor for next year . Trade tensions are another concern: 10 experts pointed to potential U.S. tariffs or related external trade frictions as a major risk . This likely reflects uncertainty over global trade policy (for instance, the possibility of renewed U.S. protectionism or unresolved tariff disputes) that could hurt Korea’s export-dependent industries. On a more positive note, recent developments suggest some easing of trade strains – a December report indicated progress in tariff negotiations with the U.S., which is expected to ease certain trade barriers in 2026 . Such an outcome could mitigate the tariff risk that experts feared, supporting Korean exports. Nonetheless, until international agreements are finalized and stable, external trade conditions remain a source of uncertainty.

Another risk highlighted is rising public debt from Korea’s expansionary fiscal policy. Seven experts (28%) flagged the rapid increase in government debt as a worry for 2026 . The Korean government has adopted a fiscal expansion stance to stimulate growth, including a record ₩728 trillion budget for 2026 that leans on heavy deficit spending . As a result, national debt is set to hit unprecedented levels – total government debt is projected to reach ₩1.4 quadrillion in 2026, with more than ₩1 quadrillion of that funded by deficit-financing (debt not backed by corresponding assets)  . Economists caution that if fiscal stimulus is overdone, it could backfire. Excessive deficit spending can fuel inflation, erode Korea’s credit standing, and deter foreign investment, ultimately worsening the balance of payments . “Expansionary fiscal policy, if too large in scale, can lead to inflationary pressure, a downgrade in national creditworthiness (harming FDI inflows), and a deteriorating current account,” warns Professor Yeom Myung-baeg of Chungnam National University . In fact, credit rating agencies have noted this concern; Fitch Ratings cautioned that Korea’s debt trajectory could eventually exceed the norm for AA-rated sovereigns, weakening its credit profile if left unchecked . Maintaining investor confidence will therefore be crucial as Korea manages its fiscal expansion.

Semiconductor Sector: A Crucial Wildcard

A key wildcard for Korea’s 2026 outlook is the semiconductor industry, which remains one of the country’s primary growth engines. In 2025, a rebound in the semiconductor cycle helped drive Korea’s exports and industrial output. However, if this sector falters in 2026, it could significantly drag down growth. The Bank of Korea has explicitly warned that if the global IT and semiconductor markets weaken, Korea’s GDP growth could fall to around 1.4% – well below the baseline forecast of 1.8% . In the experts’ survey, 6 respondents cited a semiconductor downturn as a top risk factor, underscoring these concerns .

Analysts note that demand for memory chips and other tech exports remains uncertain amid shifting global conditions. Should the chip industry contract more than it did this year, Korea could even slip into the mid-1% growth range (or worse), effectively a “low-growth trap” despite government stimulus . Professor Ahn Dong-hyun of Seoul National University cautions that if domestic demand remains sluggish and the semiconductor cycle turns downward, Korea could face a combo of high inflation and low growth – in other words, a stagflation-like scenario that would send the “misery index” upward . This highlights how heavily Korea’s recovery prospects hinge on the tech sector’s performance. On the upside, there are positive drivers in tech: increased investment in AI and high-tech infrastructure is expected to support growth . For example, capital flows into artificial intelligence infrastructure have been strong, aligning with Korea’s push toward a more tech-driven economy . If such investments bear fruit and global tech demand holds up, they could counterbalance a semiconductor slowdown. In sum, the semiconductor sector will be a decisive variable – continued strength could boost exports and GDP, while a downturn would require Korea to lean more on other sectors or policy support to sustain growth.

Growth Outlook: Moderate Recovery with Base-Effect Boost

Despite the multiple headwinds, most experts foresee South Korea achieving modest growth in 2026, in the range of the Bank of Korea’s official projection (1.8%). About **68% of the surveyed economists expect GDP growth of 1.8% or higher . Within that, 24% peg growth at 1.8%, 20% at 1.9%, 16% at 2.0%, and a minority (8%) even anticipate above 2% . This guarded optimism is partly due to base effects – 2025 was a year of subpar growth (the BOK estimated only ~1.0% growth for 2025 ), so simply reverting to trend could yield a higher rate in 2026. Additionally, the government’s fiscal drive – increased spending, investments, and possibly targeted stimulus – is expected to provide a tailwind to domestic demand and job creation . As one analysis notes, Korea’s economy is entering 2026 with some positive momentum from a “consumption upswing” domestically  and sustained export orders, which could help offset some external negatives.

Crucially, export performance will be key to hitting these growth forecasts. Strong exports (notably of semiconductors, cars, batteries, and petrochemicals) are anticipated to continue “for the time being,” according to experts, aiding the recovery . Indeed, if trade negotiations with the U.S. have eased certain tariffs and global demand stabilizes, Korean exporters stand to benefit . That said, the projected ~1.8% growth is hardly robust by historical standards – it hovers around Korea’s long-term potential growth rate, and any negative shock (such as a sharper global slowdown or a commodity price spike) could shave it down. The fact that roughly one-third of experts still foresee sub-1.8% growth means downside risks cannot be ignored. The outlook is best characterized as a moderate recovery, contingent on external stability and effective policy support at home.

Inflation Pressures Likely to Exceed Target

Inflation in South Korea is expected to remain above the Bank of Korea’s 2% target in 2026, largely due to exchange rate pass-through and sustained cost pressures. According to the expert survey, 76% of respondents believe the consumer price index (CPI) will rise more than 2.1% next year . (For context, 2.1% is the BOK’s current inflation forecast for 2026  .) The most common expectation among the experts was 2.2% inflation (40% of respondents), and an additional 28% even think inflation will exceed 2.2% . Only a quarter of experts expect inflation to stay at or below the low 2% range, reflecting broad agreement that price pressures will persist.

The primary driver cited for higher inflation is the weak currency. A continuously elevated won-dollar rate makes imports more expensive, and these higher import costs eventually feed into overall consumer prices. “If the won-dollar exchange rate keeps rising, import prices will be reflected with a lag and pull up overall inflation,” explains Professor Kim Jeong-sik of Yonsei University . This currency effect is already acknowledged by the central bank: the BOK recently estimated that if the won holds around ₩1,470 per USD through next year, it would add roughly 0.2 percentage points to inflation, implying an annual CPI increase of about 2.3% instead of 2.1% . Other factors could contribute to inflation as well – for instance, energy and commodity prices, which saw volatility in past years, and domestic wage growth, which has accelerated in some sectors. However, the general expectation is that inflation will moderate only slightly from 2023–2025 levels but remain above target due to these cost-push factors.

It’s worth noting that inflation expectations are being closely watched by policymakers. With core inflation still elevated and public expectations of prices above 2%, the BOK must weigh these dynamics carefully in its rate decisions. Indeed, by late 2025 there were signs of sticky inflation (around 3% year-on-year in mid-2025) and the central bank revised up its 2025 inflation forecast to 2.1% on the back of the weak won . For 2026, while no runaway inflation is foreseen (unlike the sharp price spikes of 2022), the consensus is that inflation will not quickly return to the 2% level. Keeping inflation in check will likely require a combination of monetary vigilance and currency stabilization efforts, especially if the won remains in a depreciated range.

Housing Market: Upward Trend Continues

South Korea’s housing market, especially in Seoul, has been another area of concern as prices rebounded strongly in 2023–2025. Looking ahead, over half of experts (56%) expect Seoul housing prices to rise further in 2026 . Only a minority (12%) forecast a price decline, while the rest (32%) see prices roughly flat . The prevailing view is that the uptrend in home prices will persist, though perhaps not at the breakneck pace seen in the past year. “Seoul and some metropolitan area home prices rose so much this year that a similarly sharp increase might be difficult,” observes Professor Kang Sung-jin of Korea University . Nonetheless, fundamental factors support continued price growth: housing supply in key urban centers remains constrained, and expectations of price appreciation are still entrenched among buyers . In other words, the demand-supply imbalance – with strong demand for homes in Seoul versus limited new supply in prime locations – is likely to keep a floor under prices.

This housing outlook has important policy implications. Rising property values contribute to wealth effects and construction activity, but they also worsen affordability and can feed financial imbalances (e.g. higher household debt). Moreover, accelerating real estate prices complicate the central bank’s task. By late 2025, Seoul apartment prices were climbing again (+0.2% in a single week of November), which the BOK noted as a challenge when considering further rate cuts . If 2026 brings another year of housing price gains, the central bank may face pressure to avoid any premature monetary easing that could overheat the property market. The financial regulator has been tightening loan rules to curb household debt tied to real estate, but those measures take time to impact prices. In summary, the housing market is expected to remain buoyant, adding to the factors the BOK must monitor to maintain financial stability.

Monetary Policy: Limited Room for Easing

With the economy confronting a “triple burden” of high exchange rates, above-target inflation, and expensive housing, the consensus is that the Bank of Korea will have limited room to cut interest rates further in 2026. In the expert survey, 44% of respondents said the BOK should not cut its policy rate any further next year, outnumbering those who advocated additional rate cuts . Only 32% felt that further rate reductions are needed to stimulate the economy, while a notable 16% believe the BOK should hike rates again to rein in inflation and financial risks . The central bank had already reduced the base rate in 2025 (bringing it down to 2.50% by late year) to counter slow growth, but it paused easing as the weak currency and rising prices became pressing concerns  . By November 2025, BOK officials dropped explicit references to maintaining a “cut bias,” signaling a more data-dependent stance on future moves .

Several factors explain why monetary policy is expected to stay cautious. First, as discussed, a weak won constrains the BOK’s ability to cut rates – lowering interest rates could further weaken the currency by reducing yield appeal, thereby importing more inflation. Governor Rhee pointed out that with the won already showing “herd-like” depreciation, more easing might fuel price pressures rather than growth . Second, inflation is still above target, so the Bank will want clear evidence of sustained disinflation before considering any rate cuts. Third, the housing market’s resurgence means rate cuts risk inflating asset bubbles; in fact, analysts have pushed back their expectations of the next BOK rate cut to Q1 2026 or later (from late 2025) because of concerns over the declining won and persistent housing price gains in Seoul  . In short, the bar for cutting rates is high – unless growth sharply deteriorates (for instance, due to a semiconductor shock or global recession), the safer course may be to hold rates steady to stabilize prices and the currency. Some even argue for a preemptive rate hike if inflation surprises on the upside, though that is a less popular view (only 4 of 25 experts advocated raising rates) .

The likely scenario is a wait-and-see approach by the BOK in early 2026, maintaining the base rate at its current level (2.5%) while monitoring economic indicators. Policymakers have emphasized that future rate decisions will balance the need to support growth with the need to ensure stability . As one economist put it, “It’s difficult to completely rule out further easing, but we are most likely to see rates on hold for the time being” . The central bank has also coordinated with fiscal authorities on measures to stabilize the FX market (for example, consulting with the National Pension Service and exporters to curb won volatility ), indicating a multi-pronged effort to manage economic risks. In summary, monetary policy in 2026 is expected to strike a cautious balance – providing some support to the economy but stopping short of aggressive easing, given the backdrop of high inflation, a weak won, and financial imbalances.

Conclusion: Outlook and Policy Challenges for 2026

In conclusion, South Korea’s 2026 economic outlook is one of cautious optimism tempered by significant risks. Growth is projected to improve slightly to the high-1% range, assuming tailwinds from fiscal stimulus and export strength offset the drags of a weak currency and soft domestic demand . However, the economy will continue to grapple with a “triple whammy” of high import costs (from the weak won), stubborn inflation, and expensive housing , with the added wildcards of external trade conditions and the semiconductor cycle. The won’s high exchange rate has effectively become an adaptive challenge for Korean businesses and policymakers – as one professor noted, 2026 will be an “important test of whether our economy can adjust to an exchange rate in the mid-to-high ₩1,400s” . Successfully managing this “new normal” will be key to a durable recovery.

Policymakers face a delicate balancing act. On one hand, they need to support growth – hence the willingness to employ expansionary fiscal policy and, if necessary, consider modest monetary easing if conditions worsen. On the other hand, they must guard against fueling instability: too much stimulus could weaken the won further, aggravate inflation, and inflate asset bubbles, undermining the very recovery they seek to promote  . The Bank of Korea’s likely stance is to hold interest rates for now, prioritizing price stability and currency stability, while the government may focus fiscal efforts on productivity-enhancing investments (such as AI and technology infrastructure) that can bolster growth without merely stoking inflation .

Ultimately, South Korea enters 2026 with considerable strengths – a competitive export sector, proactive economic management, and improving global ties (e.g. easing trade frictions) – but also with heightened vulnerability to global shocks and financial risks. If the high exchange rate persists and global demand cools, the country’s growth could underwhelm. Conversely, if Korea can navigate the external challenges and leverage its fiscal and technological initiatives, it could achieve a faster recovery than anticipated. The consensus from experts is clear: 2026 will be a pivotal year for the Korean economy to prove its resilience, requiring prudent policy calibration to maintain stability while fostering growth in the face of a testing economic landscape  .

Sources:

• Seoul Economic Daily – “2026 Economic Outlook” expert survey (Dec 2025)

• Reuters – “South Korea signals end to rate cuts as FX, price risks grow” (Nov 27, 2025)

• Korea JoongAng Daily – “Korea’s deficit-financed debt projected to exceed 1 quadrillion won next year” (Sep 2025)

• FastBull/Newsis – “South Korea Faces Credit and Fiscal Risks Despite Growth Momentum in 2026” (Dec 2025)

'경제와 산업' 카테고리의 다른 글

| 2025–2035년 원/달러 환율 전망 (0) | 2025.12.23 |

|---|---|

| 2025년 1000대 기업 CEO 출신 대학 순위 (0) | 2025.12.23 |

| 한국의 미래 vs 일본의 ‘잃어버린 30년’: 비교 분석 (0) | 2025.12.18 |

| 국내 대기업 총수 일가 거주지 분포 용산 강남 성북 성동 (0) | 2025.12.17 |

| 2025.3분기 글로벌 파운드리 시장 점유율 tsmc 삼성전자 smic (0) | 2025.12.13 |