Brand-Specific Strategy and Performance

Apple

Apple’s performance in China has been a tale of two halves in 2025. In Q3 2025, Apple’s iPhone sales dipped ~2% YoY, leaving its market share roughly flat at 13.6% . This slight decline was largely due to Q3 being an interim period before the new iPhone launch. However, Apple’s strategy of maintaining stable pricing for the iPhone 17 series (launched September 2025) with notable upgrades paid off tremendously in early Q4. In the first two weeks of October 2025, Apple’s sell-through surged – overall iPhone sell-out was up about 40% YoY  – driven by robust demand for the new iPhone 17. Notably, the base iPhone 17 nearly doubled its unit sales in China compared to last year’s base model over the initial launch period . Apple’s premium positioning and ecosystem remain key differentiators, but this year Apple also capitalized on timing and promotions: a Golden Week holiday in October and an earlier 11.11 (Singles’ Day) sales push helped boost volumes . In short, Apple’s differentiation through flagship features (better chip, improved display, higher base storage, etc.) at unchanged prices has strengthened its foothold , and its China performance rebounded strongly with the iPhone 17 launch.

Xiaomi

Xiaomi saw a modest recovery in 2025 by leaning into product innovation and an aggressive launch schedule. After a subsidy-fueled surge earlier in the year, Xiaomi’s Q3 2025 sales grew about 1.1% YoY, nudging its market share upward (it shipped roughly 10 million units for ~14.7% share in Q3)  . The real inflection came with the early launch of the Xiaomi 17 series in late September. Xiaomi timed its flagship release just ahead of Golden Week, two weeks after Apple’s iPhone 17 , catching competitors off-guard . The strategy paid off: in the first two weeks of October, Xiaomi’s sell-out volumes jumped 21% YoY . Xiaomi’s growth has been driven by its focus on premium specs at competitive prices – the 17 series introduced bold innovations (e.g. a large secondary rear display and 7000 mAh-class battery) that struck a chord with consumers . Company leadership has emphasized a “sharpened focus” on premium ($600+ segment) to compete with Apple and Huawei . The early sales results “exceeded expectations,” with over 1 million Xiaomi 17 units sold in the first week (outperforming the previous generation) . In summary, Xiaomi’s differentiation through value-for-money flagships (enhanced by its Leica camera partnership and design) coupled with savvy launch timing have reignited its growth in China.

OPPO (incl. OnePlus)

OPPO managed to grow its sales in China by 2.1% YoY in Q3 2025, a notable achievement in a sluggish market . This growth pushed OPPO’s market share above 14%, allowing it to leapfrog HONOR into the #4 position in Q3 . OPPO’s strategy has centered on product portfolio breadth and integration with OnePlus. The company benefited from strong demand for its Reno series and the popularity of OnePlus models (which OPPO counts under its umbrella) – indeed, OPPO (with OnePlus) had the steepest YoY growth among major OEMs in Q3 according to Counterpoint . OnePlus has essentially become OPPO’s performance-oriented sub-brand in China, and devices like the OnePlus Ace series bolstered OPPO’s sales (more on the Ace 5 Ultra below). OPPO also invested in innovative form-factors (e.g. Find N foldables) and offline channel strength, maintaining a broad reach in lower-tier cities. By offering everything from budget models to premium flagships (Find X series, OnePlus 11/13), OPPO differentiates through varied pricing and cutting-edge features (fast charging, imaging). In early Q4, OPPO continued to ride momentum with ~17% YoY growth in the first weeks of October【12†】, likely driven by new launches (e.g. OnePlus Ace 5 Pro/OnePlus 13R) and aggressive 11.11 promotions. In short, OPPO’s multi-brand strategy and focus on value/performance have yielded share gains in a contracting market.

vivo

vivo retained its position as China’s top smartphone vendor by volume in Q3 2025, but its sales and share saw slight declines. vivo’s Q3 sales fell about 5.9% YoY , and its share ticked down from roughly 19% to 18.5% of the market . The brand’s broad portfolio (vivo + iQOO) and deep offline presence helped it sustain leadership, but tepid consumer demand hurt vivo’s mid-range segments in particular. vivo’s strategy has been to double down on high-end models (e.g. X-series flagships and foldables) while leveraging its strong retail network for volume. This paid off to some extent – for the January-July period, vivo notably grew its share in the CNY 4,000–6,000 (~$550–$850) segment from 11% to ~17% . New models like the vivo X300 Pro (launched mid-October) are aimed at premium buyers, and initial reception was solid (the X300 Pro was the 5th best-selling model in week 42 of 2025) . Still, vivo’s YoY growth in early Q4 was modest (+2% YoY in the first two weeks of Oct)【12†】, indicating flat demand. The brand differentiates via its imaging capabilities (Zeiss partnership) and innovation in design/foldables, but in 2025 it faced fierce competition. Looking ahead, vivo’s large user base and offline strength give it resilience, but sustaining growth will require capturing more upgrade demand in the premium tier while defending its turf in the mass market.

Huawei

Huawei’s comeback in China’s smartphone market hit a plateau in late 2025. After a remarkable resurgence in 2024 (thanks to the Mate 60 series with in-house 5G chips), Huawei’s growth was constrained by supply and strategy. In Q3 2025, Huawei’s sales were down 2.6% YoY, roughly keeping its share steady at 16.4% of the market  (virtually tied with Apple for #2/#3). Huawei made a deliberate choice to prioritize high-end models and profitability over volume. It commanded a leading 34.3% share of the premium ¥4,000–¥6,000 segment in China during Jan–July 2025  – more than double any domestic rival – thanks to devices like the Mate series and foldables. However, that premium segment accounts for <20% of the market , limiting Huawei’s overall volumes. By early Q4, Huawei faced severe headwinds: in the first two weeks of October 2025, its sell-out fell 10% YoY, making Huawei the only top-six brand with a decline . Consequently, Huawei slipped to 6th place in early October (just ~12% share, vs ~15% a year ago) . The Huawei Mate 70 series (launched late 2024) continued to attract strong demand from loyal consumers, but ongoing supply constraints (Kirin chipset production) meant many buyers faced 2–3 week wait times for new Mate 70 phones . Those inventory issues, combined with very high prices for Huawei’s newest ultra-premium offerings (e.g. a foldable launched at CNY 19,999), pushed some impatient consumers to other brands  . In summary, Huawei’s differentiation via in-house technology (Kirin 5G chips) and brand cachet in China’s premium segment keeps it in the game, but limited supply and a focus on pricier models have curtailed its market share recovery in 2025.

HONOR

HONOR had a challenging year, losing ground to both domestic peers and its former parent (Huawei). In Q3 2025, HONOR’s smartphone sales dropped 8.1% YoY, and its market share slid from 15.3% to 14.4% . This drop saw HONOR fall from the #3 vendor in Q3 2024 to #5 in Q3 2025 . The primary headwinds for HONOR have been intensified competition in the mid-range segment (its core focus) and Huawei’s re-entry siphoning off some premium sales. However, HONOR found a bright spot in H2 2025 with its X70 series launch. The HONOR X70, a budget-friendly model with an enormous 8,300mAh battery, struck a chord with value-conscious buyers – it topped China’s sales charts for days after release  . Thanks to the X70’s volume, HONOR actually saw a slight 3% YoY uptick in early October 2025 sales【12†】. In the first half of October, HONOR captured 13% market share, up a bit from the prior year, climbing back into the top five vendors by unit sales  . HONOR’s strategy centers on aggressive pricing for solid specs – for instance, the X70 launched at around **CNY 1,200 ($165)**, offering features (huge battery, rugged IP69K build, 80W fast charging) unheard of at that price  . This volume-first approach has helped HONOR drive units, but it also underscores HONOR’s challenge: much of its portfolio targets the low-to-mid end, where margins are thin and competition (from Xiaomi’s Redmi, vivo’s iQOO, etc.) is fierce. HONOR’s flagship Magic series has yet to break out in the premium tier, so the brand’s performance in 2025 relied heavily on mid-range hits like the X70. Going forward, HONOR will need more such hits and perhaps stronger differentiation (e.g. unique software or ecosystems) to regain share sustainably.

Market Share Dynamics

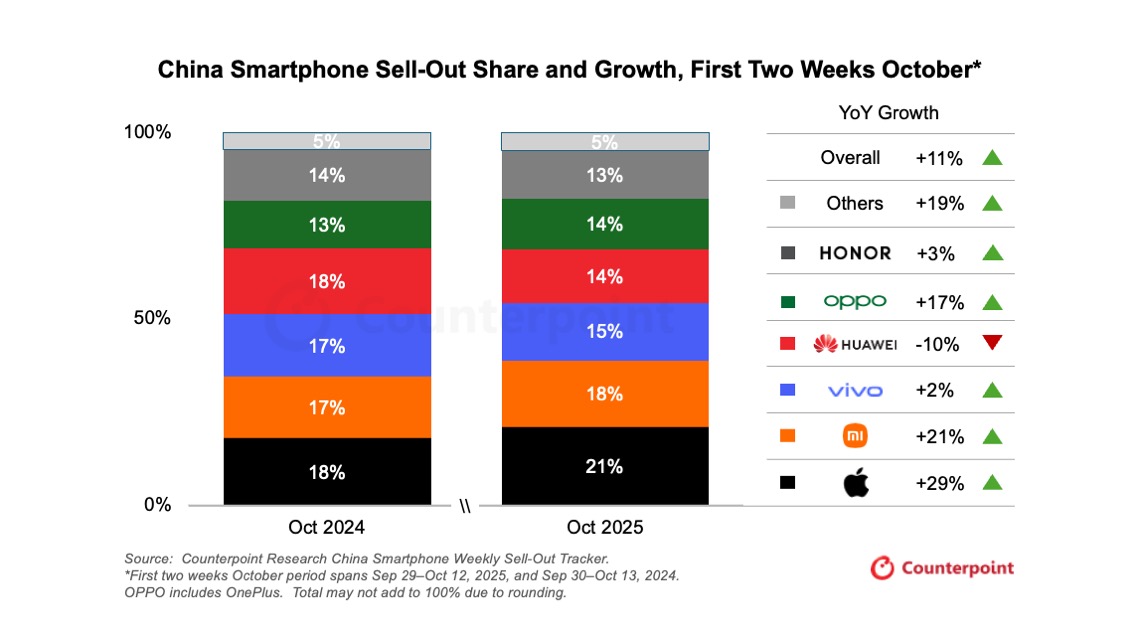

Early October 2024 vs Early October 2025 – Sell-Out Share Comparison

To gauge recent momentum, we compare smartphone sell-out market share in China for the first two weeks of October 2025 versus the same period in 2024. The table below shows the shift in share by brand:

Brand Oct 2024 Share Oct 2025 Share (First 2 weeks)

Apple ~18% (≈#1 tie) 21% (Rank 1)

Xiaomi ~16% 18% (Rank 2)

vivo ~16% 15% (Rank 3)

OPPO ~13% 14% (Rank 4)

HONOR ~14% 13% (Rank 5)

Huawei ~15% 12% (Rank 6)

Others ~6% 7% (Others)

Source: Counterpoint Research China Weekly Sell-through Tracker, Oct 2025 vs Oct 2024. (Oct 2024 shares are estimates; Oct 2025 shares from Counterpoint )

Key changes and drivers:

• Apple gained significant share, rising to 21% from roughly 17–18% a year ago, and claimed the #1 spot. This was driven by the iPhone 17’s stellar debut – Apple’s sales grew ~29–40% YoY in early October  , far outpacing the market’s +11%. Apple benefitted from a weaker year-ago period (when the iPhone 16 had a lukewarm start and faced Huawei’s surge) and this year’s strong consumer response to upgrades in the iPhone 17 series.

• Xiaomi also jumped in share from ~16% to 18%, moving up to #2. Xiaomi’s early launch of the 17 series (with high demand) helped its sales grow +21% YoY in early October . This allowed Xiaomi to closely trail Apple in share. Its aggressive Golden Week promotions and appeal in mid-range segments (e.g. Redmi models) also contributed.

• vivo saw a slight share decline, roughly from 16% to 15%, dropping from first to third. vivo’s sales were up only ~2% YoY【12†】 – lagging the market – as it faced strong competition at both the high end (where Apple/Huawei surged) and low end (where Honor/Xiaomi launched popular models). Still, vivo’s broad lineup kept it among the top three.

• OPPO edged up from ~13% to 14% share, moving from fifth to fourth place. OPPO’s early October sales grew around +17% YoY【12†】, aided by its OnePlus sub-brand’s success and solid demand for models like the Reno series. This growth helped OPPO overtake HONOR in this period.

• HONOR saw a minor share dip from ~14% to 13%, falling to fifth. HONOR’s volumes grew only ~3% YoY【12†】 – slightly under market rate – as gains from the new X70 were offset by declines elsewhere. It managed to stay in the top five thanks to the X70’s volume boost , but lost share compared to faster-growing rivals.

• Huawei suffered the largest share loss, dropping from an estimated ~15% in Oct 2024 to 12% in Oct 2025 . Huawei went from essentially tied #1 last year (when the Mate 60 Pro’s debut drove a spike) to #6. Its sales fell 10% YoY  amid supply shortages and a strategic shift to ultra-premium, making Huawei the only major brand with a YoY decline in this period. In Oct 2024, Huawei was riding high on pent-up demand for 5G phones; in 2025, that momentum cooled as Mate 70 supply constraints and competition hurt its volumes.

• Others (smaller brands combined) modestly increased share (~6% → 7%). Brands like Transsion (Tecno, itel) and niche local OEMs grew 19% YoY collectively【12†】 by filling certain price gaps and leveraging online sales, though they remain a small portion of the market.

In summary, early Q4 2025 saw Apple and Xiaomi make big share gains at the expense of Huawei and, to a lesser extent, vivo/Honor. Apple’s and Xiaomi’s growth well exceeded the market’s 11% YoY uptick , indicating they pulled in switchers or incremental buyers. Huawei’s drop highlights how significantly its fortunes reversed once its initial comeback wave receded. The overall market was up, thanks to new iPhone momentum and aggressive holiday promotions – a stark contrast to the weakness seen in prior quarters.

Q3 2024 vs Q3 2025 – Market Share by Brand

Next, we compare full-quarter market share in Q3 2025 versus Q3 2024. This captures the broader trend by brand, smoothing out short-term launch impacts. The following table summarizes sell-out share for the July–September quarter of each year:

Brand Q3 2024 Share Q3 2025 Share

vivo ~19.1% (rank 1) 18.5% (rank 1)

Huawei ~16.4% (rank 2) 16.4% (rank 2)

HONOR 15.3% (rank 3)  14.4% (rank 5)

Xiaomi ~14.1% (rank 4) ~14.7% (rank 3)

OPPO (incl. OnePlus) ~13% (rank 5) ~14.7% (rank 4)

Apple 13.6% (rank 6)  13.6% (rank 6)

Others ~8–9% ~8%

Sources: Counterpoint Market Pulse, Q3 2025 (preliminary) and Q3 2024.   (Figures rounded; Oppo+OnePlus combined; “Others” includes minor brands.)

Year-over-year share shifts and drivers:

• vivo remained the market leader, but its share slid slightly (down ~0.6 percentage points). vivo’s Q3 sales fell 5.9% YoY , a steeper drop than the market’s -2.7% . This indicates vivo lost a bit of ground. The decline reflects soft demand in vivo’s core mid-tier segments and stronger competition. Still, vivo’s extensive channel reach helped it stay #1 with 18.5% share . Driver: Minor share loss due to the lack of a major hit product in Q3 and overall market contraction, partially offset by vivo’s diverse lineup.

• Huawei held roughly steady at ~16.4% share, effectively tying for the #2 spot in both years . Its Q3 unit sales dipped only 2.6% , roughly matching the market decline, thanks to sustained demand for the Mate 60/60 Pro through mid-2025. Driver: Huawei’s emphasis on premium models kept its share stable, but component constraints prevented any share gain. The end of the initial Mate 60 frenzy meant Huawei could not grow much YoY, but it maintained its position.

• HONOR saw a notable share decline, from 15.3% → 14.4% (down ~0.9pp) . Once the #3 brand, HONOR fell to #5 by Q3 2025. Its sales dropped 8.1% YoY  – the worst among the top five. Drivers: HONOR was squeezed by Huawei’s return in the premium tier and by Xiaomi/OPPO in the mid-tier. Lacking a major flagship boost in Q3, HONOR ceded share. It relied heavily on older mid-range models, which faced intense price competition.

• Xiaomi managed a slight share increase, roughly 14.1% → ~14.7% (up ~0.6pp). Xiaomi’s sales grew 1.1% YoY in Q3 , making it (along with OPPO) one of the only brands with growth. Xiaomi rose from #4 to #3 in the rankings. Drivers: A government stimulus in early 2025 had boosted Xiaomi’s Q1, and while that effect waned, Xiaomi kept momentum with effective online sales and a refreshed mid-range lineup. By late Q3, anticipation for the 17 series may have helped clear inventory of the 13/14 series. The net result was a small share gain, reaffirming Xiaomi as a solid top-3 player.

• OPPO (with OnePlus) achieved a share rise from ~13% to roughly 14.7% (up ~1–2pp), climbing from #5 to #4. Its Q3 sales were up 2.1% YoY  – the highest growth among top brands. Drivers: OPPO’s integration of OnePlus (counted together) paid off, as OnePlus models contributed incremental volume. OPPO’s focus on product innovation (foldables, fast-charge tech) and strong offline promotions helped it steal share, particularly from HONOR and smaller brands. By Q3 2025, OPPO’s share nearly matched Xiaomi’s, a significant improvement over the previous year.

• Apple remained essentially flat at 13.6% share , ranking #6 in both periods. Its Q3 unit sales were down ~2% YoY , roughly tracking the market. Drivers: This stability belies a seasonal swing – Apple’s share was weaker in July–August (pre-launch), then surged in September with the iPhone 17 debut. As a result, Apple’s average Q3 share stayed level. It neither gained nor lost full-quarter share YoY, which can be seen as a win given the late launch timing. Apple’s loyal user base and effective channel management (price cuts on iPhone 16 Pro variants ahead of subsidies ) kept its share steady through the iPhone transition.

• Others: Combined smaller brands held roughly 8% share in Q3 2025, similar to a year ago. Drivers: Transsion, Lenovo, etc., had minimal impact on the overall share distribution. The Chinese market remains dominated by the top 5–6 brands, which accounted for ~92%+ of sales in Q3 both years.

Overall, the YoY comparison highlights a fragmenting leadership. No single brand significantly expanded its dominance; instead, vivo, Huawei, Apple maintained close positions, while Xiaomi and OPPO made modest gains at HONOR’s expense. Notably, the gap between 1st and 5th shrank – in Q3 2025 the top five were within a ~4 percentage-point band (18.5% down to 14.4%). This indicates a highly competitive market where small share shifts each quarter can reorder rankings. The slight market decline (-2.7% YoY) meant that gains came mostly at rivals’ expense, reinforcing that China is now largely a replacement market with limited growth.

Overall Market Trends and Implications

Market Growth/Decline: After a brief recovery in 2024, China’s smartphone market resumed a slow decline in 2025. Q3 2025 marked the second consecutive quarter of YoY contraction, with sales down about 2.7% YoY . Economic headwinds – a sluggish macro economy and tepid consumer sentiment – weighed on demand . Many consumers are stretching replacement cycles, leading to longer hold times for devices. However, early Q4 2025 brought a glimmer of optimism: thanks to new flagship launches and holiday promotions, China’s smartphone sell-out grew 11% YoY in the first two weeks of Q4 . This strong start to Q4 (which includes Golden Week and initial 11.11 sales) suggests the market may finish 2025 on a more positive note. Full-year 2025 volume is still likely to be flat to slightly down, but high-profile launches (iPhone 17, Mate 70, Xiaomi 17) and heavy discounting during Singles’ Day are injecting short-term lift.

Macroeconomic and Policy Factors: China’s economic conditions in 2025 have been mixed – a sluggish housing market and cautious consumer spending have constrained discretionary purchases like smartphones. To counter this, the government rolled out subsidy programs and stimulus earlier in the year (e.g. discounts for rural consumers upgrading to 5G). These subsidies temporarily boosted sales (especially for brands like Xiaomi in Q1 2025) , but their effect waned by mid-year. Still, subsidies helped support a higher average selling price (ASP) in Q3 , indicating consumers used the aid to buy better devices, even if unit volumes didn’t spike. The timing of holidays also played a role: in 2025 the Mid-Autumn Festival overlapped with the October National Day holiday, effectively compressing two shopping periods into one and concentrating demand . Meanwhile, the Singles’ Day (Nov 11) mega-sale period started earlier with pre-sales in late October, further pulling up demand into Q4 . These calendar quirks benefited brands that had new stock ready (Apple, Xiaomi), while those with delays (Huawei’s Mate 80 only launching mid-November) missed some early festive sales .

Consumer Behavior: Chinese consumers in 2025 continued to gravitate toward premium devices and affordable value – the middle got squeezed. The high end (>$800) saw enthusiasm for true flagship upgrades: Apple and Huawei, the two heavyweights of the premium segment, are in a dead heat around 15–16% share each , indicating Chinese consumers’ strong appetite for top-tier iPhones and Mate/P series. At the same time, the entry-level (<$200) and mid-range segments remain crucial for volume. Consumers here are extremely value-conscious, seeking large batteries, 5G, and durability at low prices, as seen with HONOR’s X70 success. The replacement cycle has lengthened overall (now often 30+ months), so when people do upgrade, they either splurge on a major upgrade or seek out a device that will last longer (hence interest in huge battery phones and durable builds). Nationalist sentiment that boosted Huawei in 2024 persisted but was tempered in 2025 by pragmatic factors like availability and price – many consumers want Huawei but ended up buying alternatives when Huawei was out of stock .

Seasonality and Demand Cycles: The market’s seasonality is becoming more pronounced. Weak demand in off-periods (e.g. Q2 and early Q3) is followed by sharp spikes when compelling new products arrive. 2025 exemplified this: a slow summer gave way to a flurry of Q4 activity. This indicates a mature market where major launches and promotions essentially redistribute existing demand rather than create all-new demand. For OEMs, this means timing product releases and marketing to align with these peaks is vital. Missing a cycle (or launching off-season without heavy carrier/channel support) can be costly.

Competitive Outlook: The competitive landscape in China is now fragmented and fiercely contested. As one analysis noted, 2025 saw “no clear leader” emerge, with the top five brands packed within a few percentage points of share . Leadership rotated each quarter (Xiaomi led in Q1, Huawei in Q2, vivo in Q3)  – a stark change from 2020–2021 when one or two brands (e.g. vivo or OPPO) had a comfortable lead. This fragmentation implies that brand loyalty is being tested; consumers are willing to switch based on product appeal and deals. It also reflects that growth must come at rivals’ expense now. OEMs are responding with intensified competition: faster product refreshes, more aggressive online campaigns, and ecosystem strategies (e.g. bundling wearables, IoT devices to lock users in).

Looking ahead, we expect continued intense rivalry in 2026. Apple and Huawei will duel for the high-end, while the likes of Xiaomi, OPPO/OnePlus, vivo, and HONOR battle across price tiers with slim margins. Innovation remains key – whether it’s Apple’s silicon advantage, Huawei’s satellite connectivity and chip independence, or Chinese OEMs pushing boundaries in fast charging and foldables. But equally important now is operational excellence: managing supply, timing launches, and clever marketing can tip the balance in a zero-sum share game. In a market that has fundamentally plateaued, the winners will be those who can most efficiently capture upgrades from competitors’ user bases. For consumers, this intense competition is largely positive, resulting in better specs for the price and a wide array of choices.

Key Product Highlights and Market Response

Several flagship device launches in late 2024 and 2025 have shaped the Chinese smartphone market dynamics. Below we evaluate the market response to key products, along with their pricing, specs, and strategic timing:

Apple iPhone 17 Series (launched Sep 2025)

Apple’s iPhone 17 series received an exceptional market response in China, marking Apple’s best launch in years. Within the first 10 days of availability, the iPhone 17 series outsold the previous iPhone 16 series by 14% in China (and the US) . In fact, during the initial two weeks of October, Apple’s overall iPhone sales were up ~40% YoY   – a testament to the iPhone 17’s popularity. The base iPhone 17 model was especially well-received: its unit sales in China nearly doubled compared to the iPhone 16 base model’s launch last year . Analysts attribute this to Apple delivering major upgrades without a price hike. As Counterpoint’s Mengmeng Zhang noted, “The base iPhone 17 is very compelling… offering great value for money – a better chip, improved display, higher base storage, selfie camera upgrade – all for the same price as last year’s iPhone 16.” . Indeed, Apple kept launch prices flat, which, combined with carrier promotions and trade-in deals, spurred demand. The iPhone 17 Pro and Pro Max also saw strong uptake – Counterpoint data shows the iPhone 17 Pro’s early October sell-through was almost 66% higher YoY than the 16 Pro . All three variants (17, 17 Pro, 17 Pro Max) performed extremely well, with Chinese consumers citing longer battery life (thanks to a more efficient A18 chip), the switch to USB-C, and camera improvements (especially the Pro’s periscope lens) as motivators. Strategic timing also played a role: Apple benefited from launching ahead of the 11.11 shopping festival and during a period of high foot traffic (Golden Week). In summary, the iPhone 17 series has reasserted Apple’s momentum in China, proving that iterative but meaningful improvements, paired with steady pricing, can energize upgrade cycles.

Xiaomi 17 Series (launched Sep 2025)

Xiaomi’s flagship 17 series (comprising the Xiaomi 17, 17 Pro, and 17 Pro Max) has been a headline-grabber in China’s market. Launched on September 25, 2025 – just after Apple’s release – the Xiaomi 17 series was positioned boldly to compete head-on with the iPhone. Xiaomi’s CEO Lei Jun even claimed at launch that the 17 series “surpassed the iPhone 17 in many areas”, highlighting features like an ultra-thin design and a new Leica co-engineered imaging system optimized for backlit scenes . In practice, the Xiaomi 17 series indeed introduced impressive specs: the top model carries a 7,000mAh-class silicon-carbon battery (a huge capacity while keeping the phone around 8mm thin), Leica-tuned cameras, and a vibrant 2K 120Hz display – all at a price point noticeably lower than an iPhone Pro. The market response was resoundingly positive. Within one week of launch, Xiaomi sold over 1 million units of the 17 series, outperforming the initial sales of its prior generation . Demand was so high that Xiaomi’s president Lu Weibing apologized for insufficient stock and supply bottlenecks as eager consumers snapped up the phones . Counterpoint notes Xiaomi’s sell-out jumped 21% YoY in early Q4, “supported by the early launch of the Xiaomi 17 series” . Chinese consumers have been drawn to the Xiaomi 17’s value proposition – it offers many high-end features (fast Snapdragon chipset, large memory options, periscope zoom camera on Pro Max) at a relatively accessible price (the base Xiaomi 17 starts in the ~$600 range). Moreover, Xiaomi’s decision to launch earlier in the fall (a few weeks before its usual cycle) gave it a head-start against other Android rivals, capturing pent-up demand during Golden Week . Another highlight is the phone’s unique rear display (on Pro models) which is both a design statement and functional (for notifications or selfies). This kind of differentiation, along with aggressive marketing (leveraging Lei Jun’s popular annual product speech event), has translated into the 17 series exceeding sales expectations. It reinforces Xiaomi’s strategy to conquer the premium segment by undercutting incumbents while offering top-notch specs – a strategy that, for the 17 series, appears to be working in China.

OnePlus Ace 5 / OnePlus 13 Series

Under OPPO’s umbrella, OnePlus has continued to bolster its “flagship killer” reputation in 2025 with the OnePlus Ace 5 series in China and preparations for the OnePlus 13 globally. The OnePlus Ace 5 Ultra (launched May 2025 in China) and its sibling Ace 5 Racing Edition stunned the market with their phenomenal price-to-performance ratio . These devices are essentially high-end phones sold at mid-range prices, and they played a key role in OPPO’s share gains. The Ace 5 Ultra features a large 6.83-inch 144Hz AMOLED display, the high-end MediaTek Dimensity 9400+ chipset, and a massive 6,700mAh battery with 100W fast charging  . Even more astounding, the Ace 5 Racing pushes battery capacity to 7,100mAh (one of the largest in any smartphone) with 80W charging , while using a still-capable Dimensity 9400E. Despite these specs, pricing starts at just CNY 2,499 (≈$345) for the Ace 5 Ultra , and the Racing edition is even cheaper (around CNY 2,299, <$320). These “insanely affordable” price points for such well-equipped phones generated substantial buzz , drawing in consumers who want top-tier battery life and performance without paying flagship prices. OnePlus (OPPO) strategically kept these models exclusive to China, allowing them to cater to local market needs (e.g. huge battery for heavy users, gaming performance for youth) without cannibalizing its global premium lineup. The approach bolstered OPPO’s sales in mid-2025 and gave OnePlus a stronger foothold in the mid-range segment in China.

Looking ahead, OnePlus is gearing up the OnePlus 13 series (its next global flagships, expected around late 2025 or early 2026). The OnePlus 13 (and 13 Pro) will likely inherit some of the Ace 5’s ethos – delivering top specifications (e.g. Snapdragon 8 Gen3/8 Elite chip, high-refresh LTPO displays) at prices slightly below Samsung/Apple flagships. In China, the OnePlus 13 may launch as part of the OnePlus 15/Ace 6 nomenclature (OnePlus has been aligning numbering with OPPO’s cycle). In any case, OnePlus’s recent devices underscore a differentiation strategy based on value and raw specs: huge batteries, fastest charging, high-end processors, and clean software. This strategy has resonated in China – the Ace 5 series helped attract performance enthusiasts and cost-conscious buyers, contributing to OPPO’s 17% YoY growth in early Q4【12†】. With the upcoming OnePlus 13, the brand is poised to continue challenging the status quo in the premium segment internationally, leveraging the momentum and credibility it built at home with devices like the Ace 5 Ultra.

HONOR X70

HONOR’s X70, launched in July 2025, emerged as a surprise hit in the budget segment and a testament to how much value can be packed under $200. Marketed with the tagline of having “twice the battery capacity of flagship phones for a fraction of the price,” the HONOR X70 indeed features a record-breaking 8,300mAh battery – enormous by industry standards – yet is priced at only CNY 1,199–1,699 (~$165–$235 depending on version)  . This phone also boasts military-grade durability (IP69K) and 80W fast charging, all in a device just 8.2mm thick  . These specs resonated strongly with consumers in China’s lower-tier cities and price-sensitive segments. Within days of release, the HONOR X70 topped sales charts – it was the #1 selling smartphone in China for at least three straight days post-launch  . During one of the October weekly sales periods, the X70 was the 4th best-selling model nationwide, only behind Apple’s new iPhones . Its success single-handedly lifted HONOR’s unit sales, pushing HONOR back into the top-5 brands by volume in early Q4  . The strategic timing of the X70’s release was clever – arriving just before summer and well ahead of the 11.11 festival, it faced little competition in its price tier offering such standout features. It also filled the void left by Huawei’s absence in the sub-$200 range. The X70’s message was clear: high battery longevity and toughness for all-day use, which struck a chord with students, delivery workers, and rural consumers who prioritize battery life and reliability. The inclusion of a relatively new Snapdragon 6 Gen 4 5G chipset ensured performance was decent for everyday tasks . HONOR’s aggressive pricing (enabled in part by national e-voucher subsidies applied to its price ) undercut rivals. In summary, the HONOR X70 exemplified how extreme battery capacity and durability at an ultra-low price can be a winning formula. Its strong market reception has likely encouraged HONOR to continue focusing on the mass market, even as it doesn’t do much for the brand’s profit margins. For the market, the X70’s success shows there is still significant demand for innovation in the budget segment – innovation not in processing power, but in battery tech and ruggedness.

Huawei Mate 70 Series

Huawei’s Mate 70 series (launched in late November 2024, with sales continuing through 2025) played a pivotal role in Huawei’s attempt to reclaim its former glory. The Mate 70 Pro and Pro+ were the first full-year flagship models from Huawei to showcase its in-house Kirin 9000-series 5G chipset since the U.S. tech sanctions – a continuation of the breakthrough started by Mate 60. In terms of market impact, the Mate 70 series had a strong start but faced challenges maintaining momentum. Initially, the Mate 70 Pro was met with enthusiasm: Huawei loyalists and tech enthusiasts flocked to it for its cutting-edge features (e.g. a purported Kirin 9020/9100 chip on a 7nm-class process enabling 5G  , a variable-aperture XMAGE camera, satellite messaging, etc.). The phone’s performance showed that Huawei could nearly match Apple’s latest chips in many tasks, bolstering national pride in homegrown tech. However, by mid-2025, as competitors launched new models, the Mate 70’s shine had started to wear off.

One major issue was limited supply. The Kirin chips, produced domestically in limited quantities, meant the Mate 70 series was often out-of-stock. Even in October 2025 – nearly a year after launch – the Mate 70 Pro was sold out with 2–3 week wait times for delivery . This surely capped Huawei’s sales – some eager buyers simply couldn’t get their hands on the device, and some gave up waiting and bought a Xiaomi 17 or iPhone 17 instead . Another challenge was Huawei’s pricing strategy: the Mate 70 Pro and Pro+ were priced at the very high end (above CNY 6,000, similar to iPhone Pro pricing), and Huawei even released a Mate 70 RS Ultimate Design edition priced around CNY 12,000+, as well as ultra-expensive foldables (Mate X series). This premium pricing and focus on >$800 devices meant Huawei was targeting a narrow slice of the market. While Huawei did achieve industry-leading share in the premium segment (34% of ¥4k–6k as noted) , it left volume on the table in mid-range segments where Huawei had virtually no offerings. The Mate 70 series thus sold primarily to Huawei’s loyal high-end customer base, but wasn’t able to convert many users away from Apple or vivaciously expand Huawei’s base.

That said, the implication of the Mate 70 series for the market is significant: it proved that Huawei’s comeback was real and not just a one-quarter blip. The Mate 70 (and the later P60/P70 series) re-established Huawei as a contender in the premium space, forcing Apple to pay closer attention (Apple even noted a surprising sales drop in China in Q2 2025, likely due to Huawei’s gains ). The Mate 70’s presence kept pressure on domestic competitors too – for instance, Xiaomi accelerated its 17 series launch partly to pre-empt Huawei’s next Mate. In summary, the Huawei Mate 70 series had an initial blockbuster reception but then a constrained follow-through. Its leading-edge features under sanctions (5G, satellite comms) earned admiration and buoyed Huawei’s brand image, yet supply and pricing limitations meant its full market potential was not realized. Huawei is betting on follow-ups (Mate 80, etc.) to continue this trajectory, but as 2025 showed, even the best products need to be readily available and competitively timed to alter market share significantly.

⸻

Sources: The above analysis is based on Counterpoint Research data and reports (as of November 2025), including weekly sell-through trackers and the Q3 2025 Market Pulse  , as well as insights from news outlets like Reuters and industry media for specific product launches  . All statistical claims and direct quotes are cited from these sources. This comprehensive view highlights how each major OEM’s strategy and hero products have played out in China’s highly competitive smartphone market. The remainder of Q4 2025 will reveal whether early gains (especially for Apple and Xiaomi) translate into sustained momentum, but it is clear that innovation, timing, and execution are more critical than ever in determining winners in China’s smartphone landscape.

'IT & Tech 정보' 카테고리의 다른 글

| 2025년 3분기 전세계 PC 출하량 전년 대비 8.1% 상승 – Windows 10 지원 종료와 관세 이슈가 시장 회복 촉진 (0) | 2025.11.07 |

|---|---|

| Global PC Shipments shares 2025 (0) | 2025.11.07 |

| 2024-2025 중국 스마트폰 시장 동향 종합 분석 (0) | 2025.11.07 |

| China Telecom at MWC 2025: Driving Telecom Innovation with AI and Sustainability (0) | 2025.11.03 |

| Huawei at MWC 2025: A Grand Showcase of XR, AI, and Digital Infrastructure (0) | 2025.11.03 |